Workforce Equity Funds

A unique investment opportunity to invest in workforce communities founded on strategic and mission-aligned partnerships.

Middle income and affordable multifamily housing supply shortfalls are widespread, well-documented, and represent an opportunity to access attractive risk-adjusted returns.

We have made the strategic decision to form partnerships with the best groups in this space and create unique opportunities for our investors to benefit from the scale, resources, and expertise of the leading investment managers in the market.

Investment Opportunities

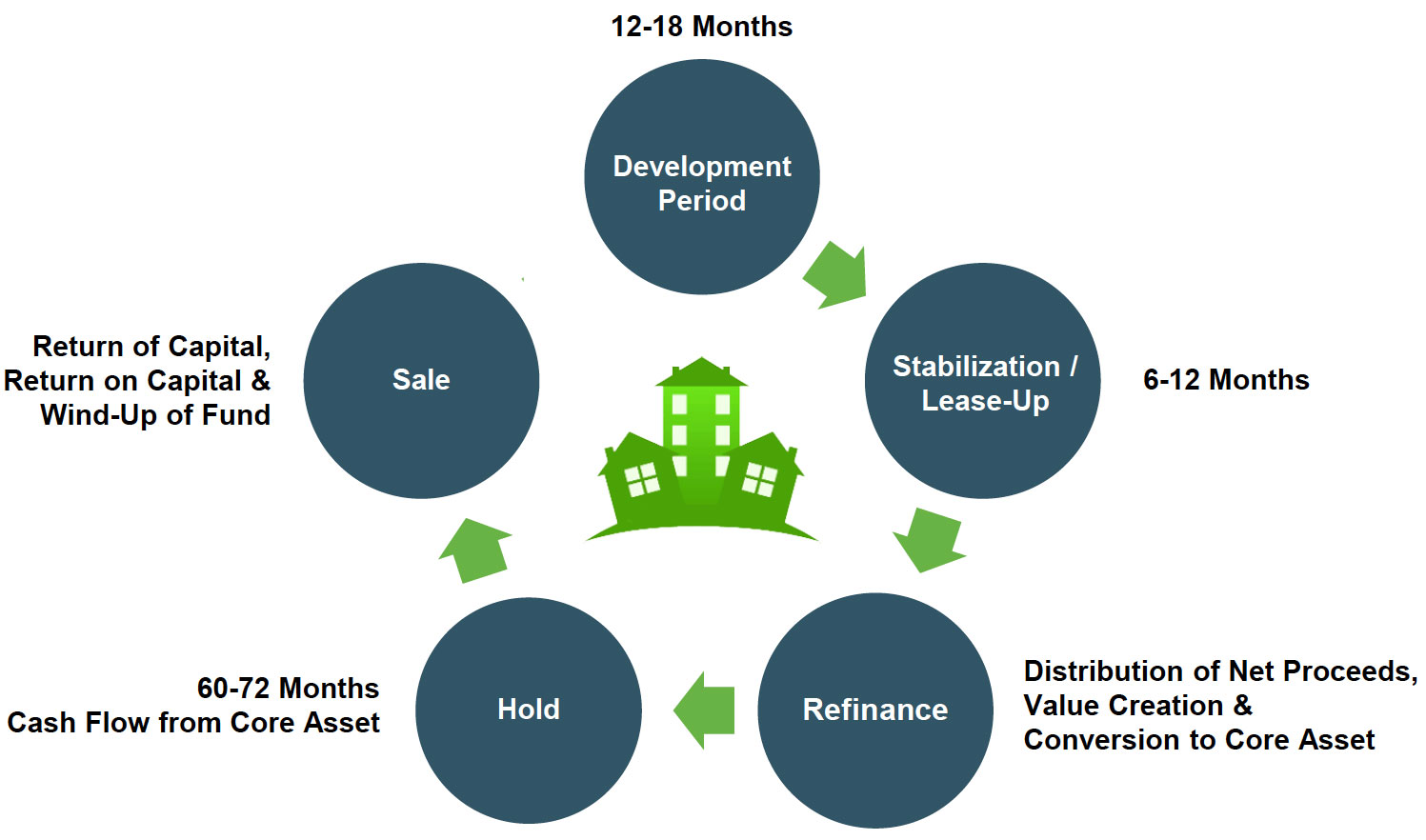

Develop Workforce Apartments

Refinance | Hold | Sell

High-quality, new-build, urban, multifamily properties at a 30% to 40% cost advantage relative to nearby conventional competitors.

The goal of delivering high-quality housing at a significant cost advantage relative to conventional multifamily product, in amenity-rich urban locations. This “Fund-of-Fund” structure allows you, as a passive investor, to take advantage of Thrive’s expertise in evaluating the investment strategy and holdings to gain exposure to high-quality workforce housing at an attractive risk-adjusted return.

How is this strategy differentiated?

Civicap Partners invests in workforce housing in desirable urban infill locations, increasingly dominated by luxury products. We believe that attractive, newly built apartments in urban core locations with affordable rents will enjoy deep market demand and strong through-cycle performance.

Develop To Core Lifecycle

Operate & Update Workforce Apartments

Hold for Cash Flow | Sell

Why SIMFA? Strong fundamentals, a fragmented marketplace, and attractive financing make workforce housing an amazing sector.

Social Impact Multi-Family Asset (SIMFA) is dedicated to assembling and creating a portfolio of workforce housing communities with the primary goal of enriching resident’s lives while generating above-market returns for investors.

SIMFA’s mission is to achieve a higher purpose of building thriving communities and enriching lives. We aim to be responsible stewards of investor capital while upholding the highest standards of fiduciary responsibility. Our responsibility extends to all stakeholders including our investors, residents, team, environment, and the communities we serve.

Investment Objective

To create, renovate, and preserve workforce housing apartments — defined as rents between $600-$1,300/month — in markets that have a supply/demand imbalance. This will serve as a vehicle for social impact and environmental sustainability while generating compelling risk-adjusted market returns.