The Changing Landscape of Affordable Multifamily Housing and Investing

Affordable housing has been a pressing issue across the United States, with demand far exceeding the supply of both single-family residences (“SFR”) and multifamily housing (“MFH”). However, amidst this challenge, there are positive developments in the affordable housing market. This article explores the changing dynamics of affordable housing, the growth of multifamily construction in key markets, and the investment opportunities emerging in the sector.

Wage Increases Struggle to Keep Up with Rent Growth

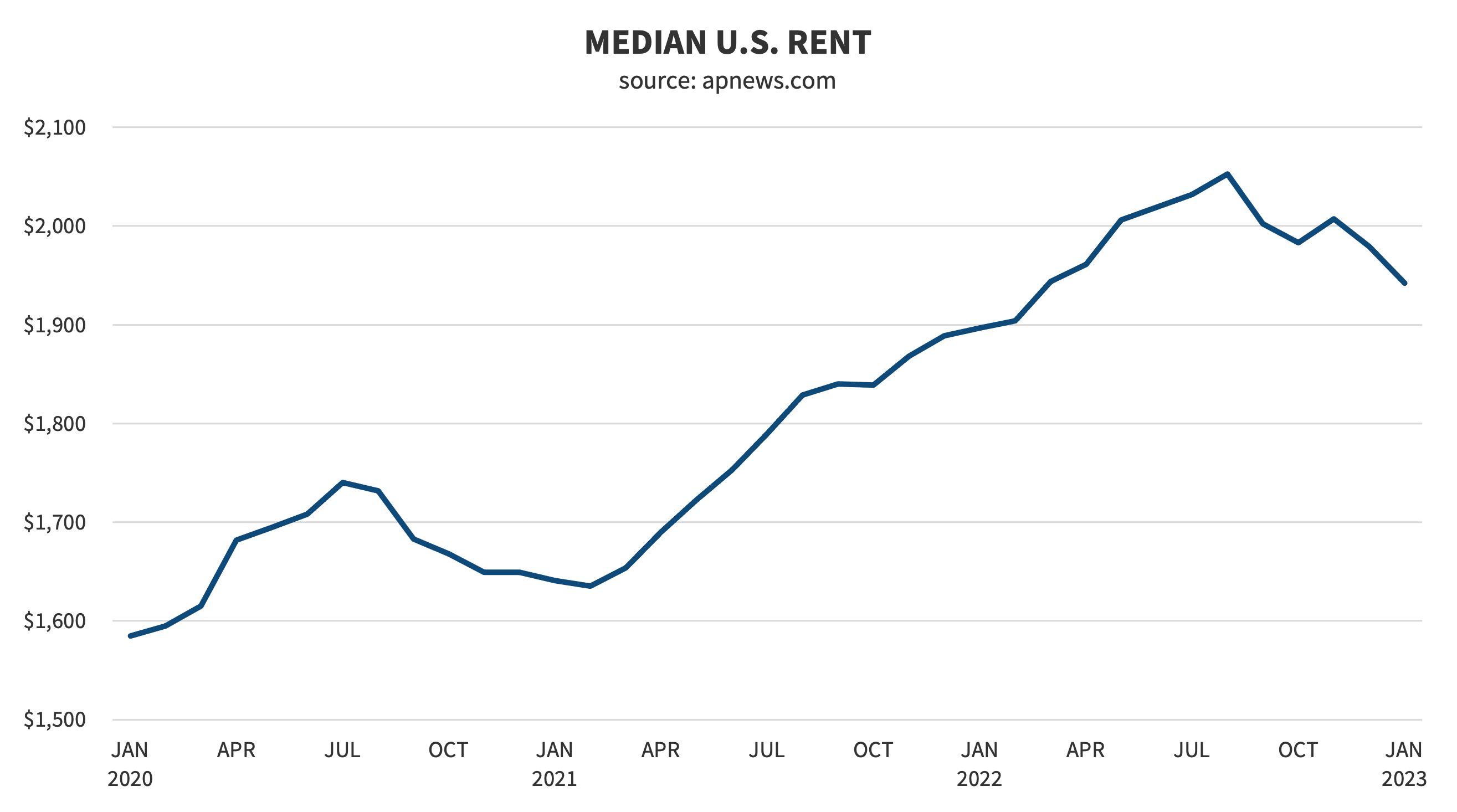

Moody’s Analytics economists, a leading source of data research and financial intelligence, reported that as the disparity between rent growth and income growth widens, Americans’ wallets feel financial distress as wage growth trails rent growth.

Over 19 million U.S. renter households spent more than 30% of their income on housing costs in 2021, according to data from the 2017-2021 American Community Survey (ACS) 5-year estimates. These households are considered cost burdened when they spend more than 30% of their income on rent, mortgage, and other housing needs.1

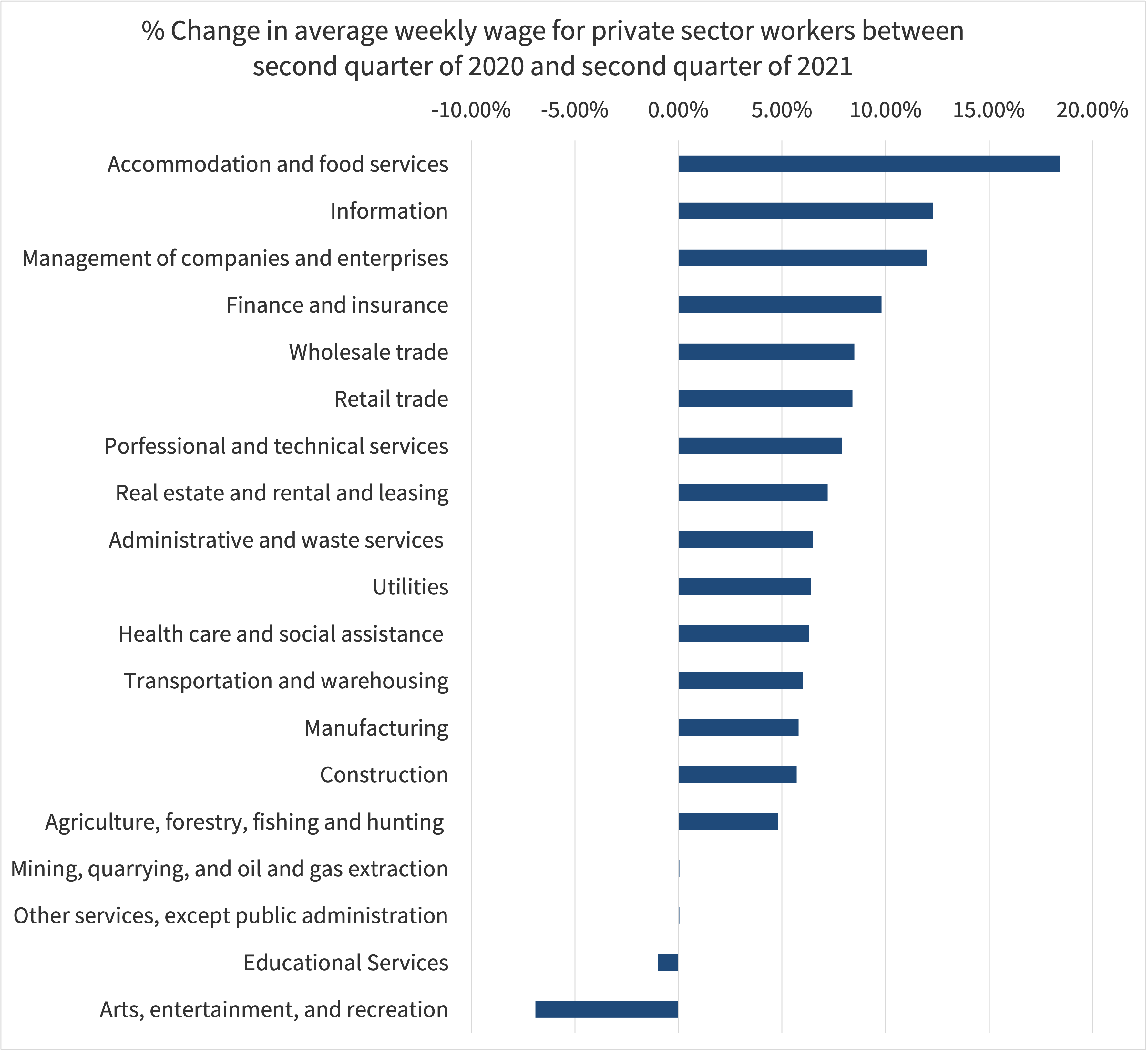

Compare the drastic rate of rent increase with wage growth. Since the lockdown in 2020, the hospitality sector wages have risen the most at 18.4%. Still, essential workers in health care only increased by 6.3%,2 making rent nearly unaffordable for many working-class individuals when the U.S. annual rate of rent growth topped out at nearly 18% in March 2022.

Meeting the Demand for Affordable Housing

Across the nation, not a single state has enough affordable SFR or MFH units to meet the demand. In fact, there is an estimated shortfall of 5.5MM affordable rental homes nationwide3. These factors have prompted a shift in the affordable housing market, driven by sustainable and innovative development and cost reduction aproaches. Local authorities offering tax credits and funding incentives for social impact programs have played a crucial role in promoting significant improvements in affordable housing through competitive requests for proposals.

The U.S. has a critical undersupply of workforce housing.

Creating Vibrant Communities

Studies have shown that vibrant, mixed-income communities lead to better social cohesion and economic prosperity, with a 15% increase in economic output observed in areas with diverse housing options4.

A key focus of affordable housing initiatives is to avoid segregating communities based on income levels. To achieve this, affordable buildings are designed to be visually appealing, with their own distinctive character. By using different materials while maintaining quality, affordable housing projects contribute to neighborhoods’ overall aesthetics and diversity. This approach aligns with the notion that sustainable cities thrive by ensuring a diverse mix of people.

Affordable housing buildings can be visually appealing and contribute to vibrant, diverse communities.

While luxury and Class A apartments often feature high-end finishes and amenities, affordable housing projects adopt a more practical approach. The focus is on selecting durable and cost-efficient materials that do not compromise on quality but may have a more straightforward aesthetic. However, it is essential to note that affordable buildings are designed to meet the community’s needs and not necessarily mimic the luxury segment.

As investors, this trend presents both opportunities and considerations. By embracing the unique character of affordable buildings, investors can contribute to creating diverse and inclusive communities. This aligns with sustainable urban development principles and can positively impact the long-term value and attractiveness of the investment.

Multifamily Construction Trends

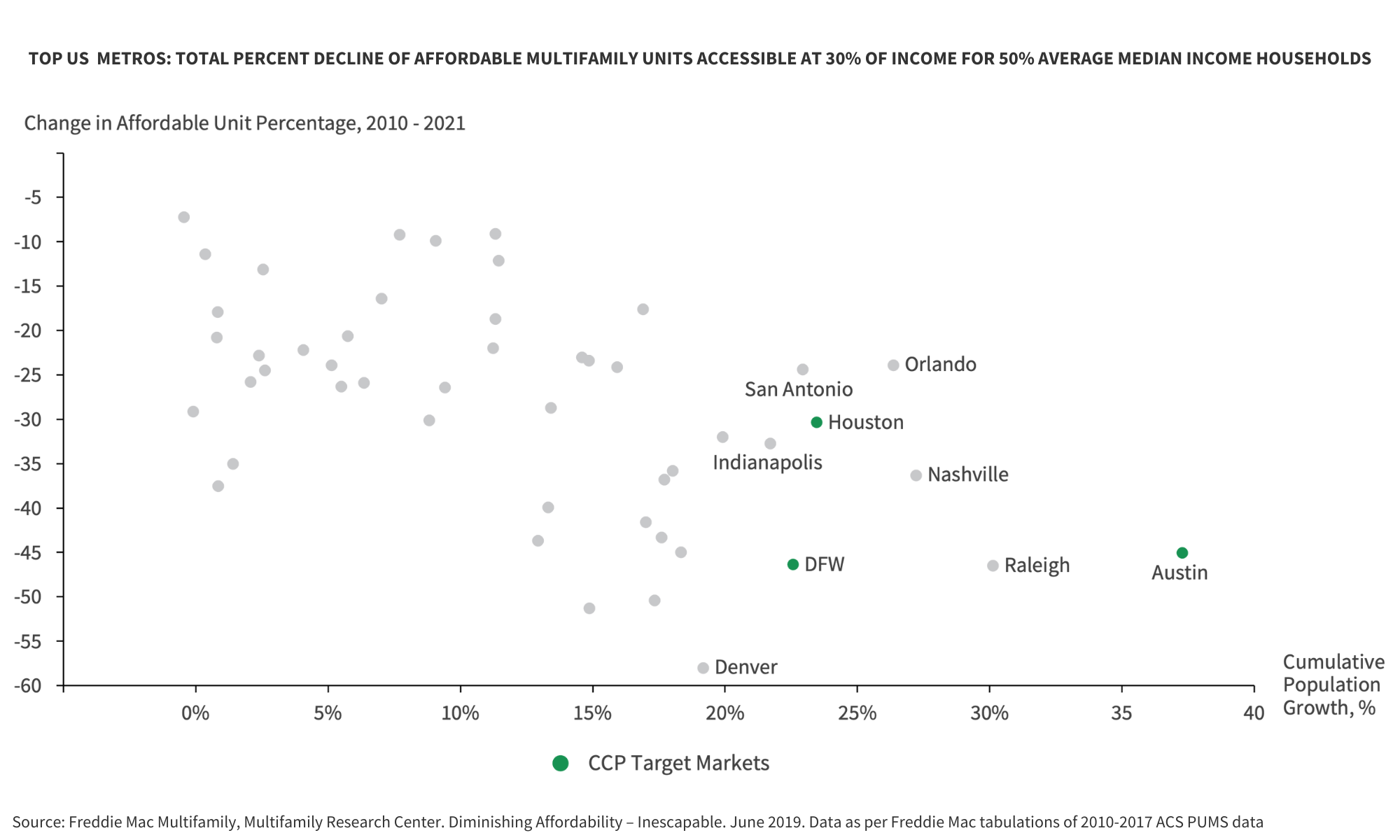

Texas continues to lead the way in multifamily construction, with Austin, Dallas, and Houston ranking among the top 10 metros in the country. Texas accounts for a significant portion of the national multifamily construction activity, with an estimated 28% increase in permits issued from November 2021 to November 20225. The state’s attractive markets provide excellent opportunities for long-term investments. Investors can benefit from longer stabilization periods and capitalize on the sustained growth of these markets.

Recommended article: The Texas Multifamily Housing Boom: Addressing Demand, Seizing Investment Opportunities

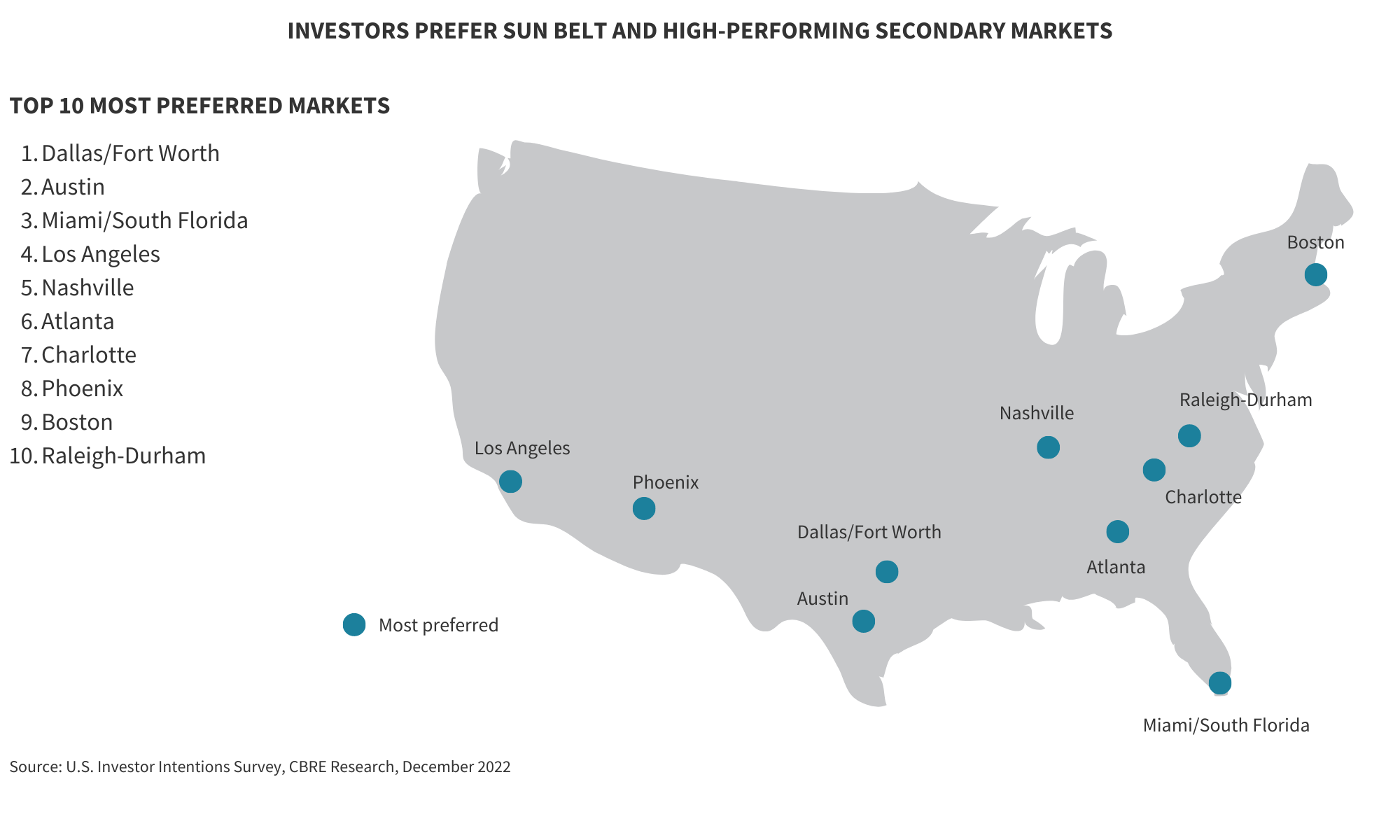

Investors Prefer the Sunbelt Region

CBRE research reported that investors are still drawn to thriving secondary markets, especially in the Sun Belt region. Texas cities like Dallas and Austin are anticipated to exhibit exceptional performance. Multifamily properties, especially apartment complexes, continue to be highly sought-after. Industrial space, grocery-anchored retail, and Class A office investments in major market also garner significant interest.

Population Growth and Housing Demand in Texas

Texas is experiencing significant population growth, with major cities like Dallas and Austin leading the way. Dallas-Fort Worth-Arlington, Texas, saw a remarkable 16% population increase from 2010 to 2020, outpacing the national average of 7.4%6. This surge in population, coupled with companies relocating their operations to Texas, has resulted in a heightened demand for housing. As a result, the need for more affordable housing options has become increasingly apparent.

Conclusion

The affordable housing landscape is undergoing significant transformations, with a focus on sustainability and innovative design. Multifamily construction continues to thrive in key markets, particularly in Texas, offering attractive investment prospects for those seeking long-term stability. With these developments, the affordable multifamily housing sector presents promising opportunities for the housing market, investors, and essential workers alike.

In the ever-evolving world of commercial real estate investing, adaptability and a keen understanding of market shifts are the keys to prosperity today. We would like to share with you information that sheds light on the transformations taking place and where we see opportunities ahead. Contact us to schedule a call.

Sources:

- https://www.census.gov/library/stories/2022/12/housing-costs-burden.html

- https://www.pewresearch.org/short-reads/2021/12/22/many-u-s-workers-are-seeing-bigger-paychecks-in-pandemic-era-but-gains-arent-spread-evenly/

- National Association of Realtors

- Urban Land Institute

- National Association of Home Builders

- U.S. Census Bureau