The Texas Multifamily Housing Boom: Addressing Demand, Seizing Investment Opportunities

Over the last decade, Texas has seen a significant increase in demand for apartment housing across the entirety of the state. The state’s rapid population growth, booming economy, and the rising cost of homeownership have intensified the demand for rental housing. In this article, we will explore the statistical trends that illustrate the changing landscape of affordable multifamily housing in Texas and the investment potential it presents.

Population Growth and Housing Demand

According to USA Facts, Texas ranks among the fastest-growing states in the nation, with an average annual growth of about 1.4% from 2010 to 2021. On average, Texas has gained over 400,000 residents annually since 2000. Comparatively, the US population only grew about 0.7% year over year from 2010 to 2021, meaning that Texas is growing twice as fast as the national average. Moreover, census data showed the population surpassed 30 million in 2022 and could reach 55 million by 2050. This influx of residents has created a significant demand for affordable housing, exceeding the available supply.

Texas has one of the nation’s most diverse and rapidly growing economies. The state leads massive industries such as energy, technology, and manufacturing. More specifically, larger cities such as Austin, Dallas, and San Antonio have become major hotspots for businesses and families. The continued in-migration of people to these cities has increased the demand for rental housing as housing prices and mortgage rates rise from inflation limits homeownership.

The Affordability Challenge

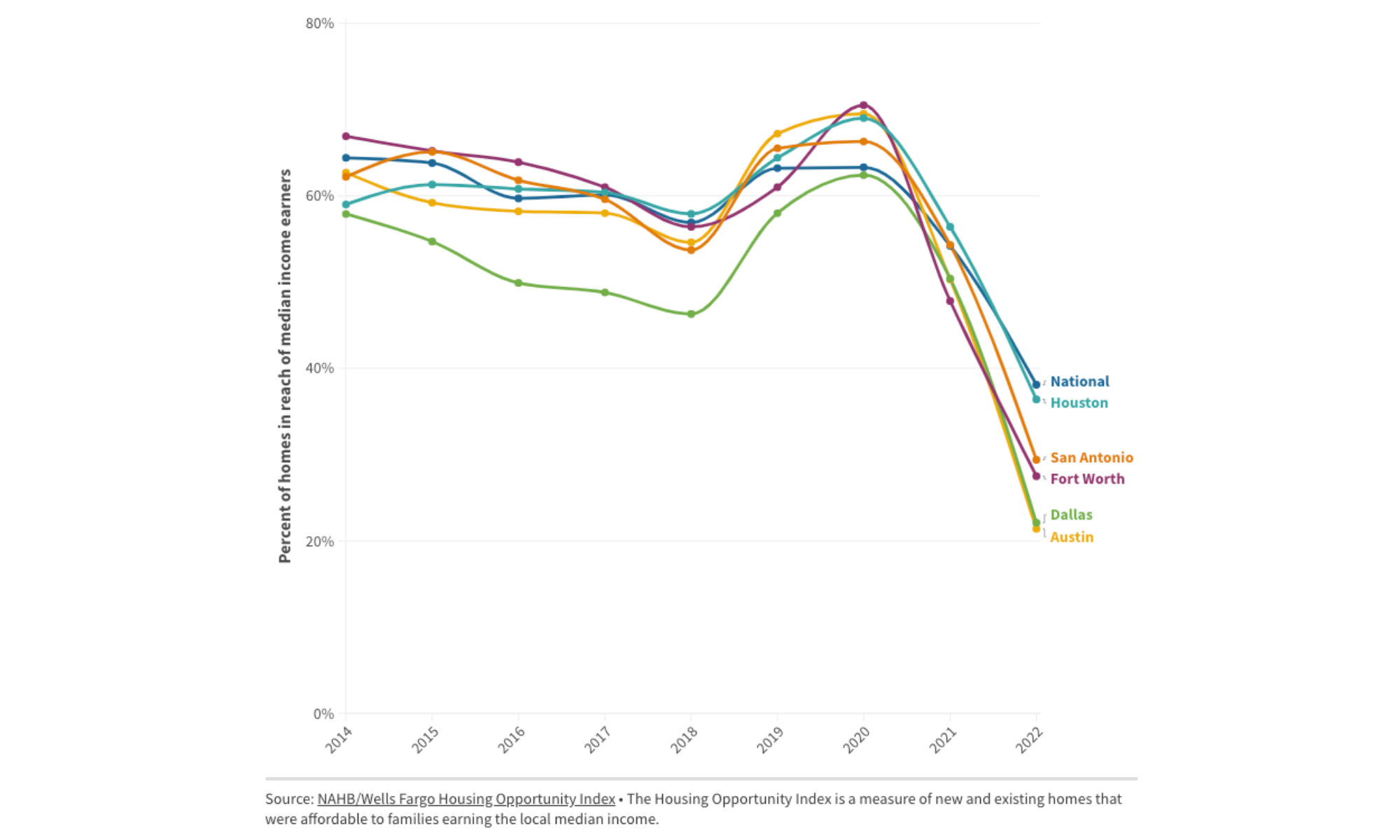

However, this expansion of the economy has created notable housing affordability issues. Over the past two years, affordability in Texas’ largest cities fell twice as hard compared to the nation. Less than 30% of homes in the largest Texas metros were affordable to residents earning the local median income. Even worse, the numbers in Austin and Dallas are approaching just two in ten homes. Looking back to 2021, the four metros shown below were less affordable than the national average.

While owning a home remains a goal for many, rising costs, including property prices and interest rates, have made renting a more attractive choice for many Texans. Additionally, renting offers flexibility and avoids the financial commitment associated with homeownership. However, the growing barrier to entry for purchasing a home has fueled the demand for apartment living, driving the need for affordable housing properties in Texas. From 2000 to 2021, Texas issued about 243,000 housing permits per year. These permits do not nearly keep up with demand considering the state’s population grew by 475,000 from July 2021 to July 2022. Additionally, a large percentage of the homes being built are not affordable to those who make the median income.

The Rise of Multifamily Housing

Apartment living also offers a level of flexibility and affordability that owning a home does not. With shorter lease terms, people can easily adapt and relocate in the rapidly evolving economy. Buying a house entails years of obligation with little room for adjustability. During the pandemic, uncertainty and economics presented hurdles that emphasized the need for flexibility. Renting an apartment offered the option of downsizing or relocating more easily and without all the intricacies of selling a home. The pandemic emphasized the benefits of apartment living, highlighting the need for flexible housing options and causing demand for affordable rental properties to surge.

Recommended article: The Changing Landscape of Affordable Multifamily Housing and Investment Opportunities

Investment Opportunities

While the single-family housing market in Texas struggles to keep up with the affordability demand, the multifamily housing sector presents promising investment opportunities in Texas. The state’s multifamily construction pipeline indicates an increase in supply, helping to alleviate the high demand. Austin, Dallas, and Houston rank in the top ten for multifamily construction units being built, with a combined count of 157,114 in 2023, the highest of any state in the US. This growth in supply will contribute to an improved rental market while meeting the evolving needs of residents.

“In an ever-evolving economic landscape, the outlook for workforce housing investment remains undeniably robust, buoyed by the steadfast fundamentals of supply and demand,” says Thrive CEO, JP Newman. “As the demand for affordable multifamily housing continues, the long-term prospect for a solid investment is what Thrive has built its success.”

Conclusion

Texas is facing an unprecedented demand for multifamily housing due to population growth, economic prosperity, and housing shortage. The state’s diverse job market position it to capitalize on the continuous influx of people. With the rise of affordable multifamily construction, Texas has an opportunity to address the growing need for rental housing while fostering a robust housing market that remains among the highest in the nation and will continue to boom in the coming years.